Cardano Approves Critical Integrations Budget In Key Vote

Cardano’s governance process closed out 2025 with a tangible green light: the “Critical Integrations Budget Info Action” has been ratified, a step EMURGO framed as foundational to getting priority ecosystem integrations funded and executed.

In a post on X late Tuesday, EMURGO said the action cleared with “6 out of 7 Constitutional Committee approval and over 85% DRep support,” positioning the proposal to move into its next, more consequential phase. “With the BIA complete, focus now shifts to the Treasury Withdrawal Action,” EMURGO wrote. “This next step transitions the proposal from intent to execution which requires continued active review and support from the CC and DReps.”

Why This Is Crucial For Cardano

The distinction matters in Cardano’s post-Voltaire governance flow. The Budget Info Action signals alignment around scope and direction, while the Treasury Withdrawal Action is the point at which the ecosystem’s intent is translated into an on-chain withdrawal, meaning governance scrutiny typically intensifies as the discussion moves from principle to disbursement.

EMURGO also used the moment to emphasize that the process is already yielding concrete outputs under what it called the “Critical Integrations framework,” describing coordination across the “Pentad” that includes Input Output (IOG), the Cardano Foundation, EMURGO, Intersect, and the Midnight Foundation.

Two integrations were highlighted as already confirmed. The first is Pyth Network, which EMURGO described as “real time, institutional-grade market data coming to Cardano,” aimed at supporting DeFi primitives that depend on robust price feeds. EMURGO pointed to use cases including “lending, derivatives, stablecoins, and onchain risk management,” underscoring that oracle availability remains a gating factor for more complex on-chain markets.

The second is Dune, which EMURGO said will bring “Cardano data integrated into a shared analytics platform used across the industry,” making on-chain activity “easier to analyze, compare, and build on.” For builders and funds that already rely on common analytics tooling across ecosystems, the pitch is straightforward: lower friction for monitoring Cardano activity alongside other chains, and less bespoke infrastructure work to get dashboards, queries, and reporting into production.

EMURGO cast the vote outcome as an indicator of governance maturity and ecosystem alignment, explicitly thanking Constitutional Committee members and DReps for participation “even during the holiday period.” It also framed the timing as a setup for 2026 execution, writing that “this momentum reflects an ecosystem working together with a shared goal” and that Cardano is “positioned to enter 2026 stronger, more capable, and ready to support the next phase of ecosystem growth with these critical integrations in place.”

The near-term question now shifts to whether the Treasury Withdrawal Action maintains similar levels of support as the conversation moves from approvals to actual treasury spend, an inflection point that will test not just consensus, but the community’s appetite for follow-through on what “critical integrations” should look like in practice.

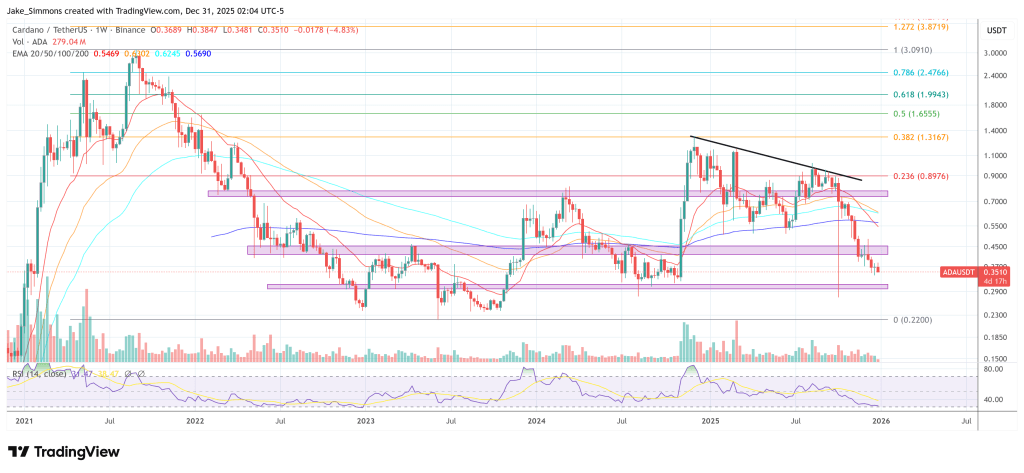

At press time, ADA traded at $0.351.

Featured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.